How China Stretches the Minds of Global Business Strategists?

By Edward Tse

September 2022

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse.

The Evolving Context

Everyone knows China has grown at a rapid pace in the last few decades and has already become the world’s second largest economic power. Besides, now it is also a large market for many industries and a major epicenter of manufacturing and supply chains. In the last few years, in the midst of shifting global geopolitics, it has become a center of attention for the whole world.

Three decades ago, after Deng Xiaoping made his landmark “Southern Tour”, multinational corporations (MNCs) began to invest in China in large numbers. That process has continued and intensified since then. Along the way, the nature of MNCs’ China strategies has evolved as have the China context, the global context and China’s role in the world economy.

When the MNCs first came to China, they would typically bring with them a number of behavioral attitudes. They believed the products they had been selling in other parts of the world and the business models that they had been adopting would equally apply to China. So, they used to “copy and paste” their business approaches to China and expected that to work. At the same time, MNCs didn’t see Chinese companies, who were typically rudimentary in their products, technology and business models at the time, as qualified competitors. MNCs would view only other MNCs from other parts of the world as their competitors. Some MNCs viewed local Chinese companies as their workshops. Partnering with Chinese companies was, for MNCs, only a way of leveraging low operating costs that helped lower their own costs. Many MNCs felt that they could come and simply “take over” the Chinese market as they thought they knew how to run a business better than the locals.

Different Experiences

Over the years, MNCs’ performance in China has varied a great deal. Some came, gave it a try, and couldn’t find the results they expected. Some of these companies decided to reduce their presence in China while some simply retreated. Others came and after a while, they found China to have become one of their largest markets in the world and a major source of value creation. And for some, China has become the epicenter of their global supply chains.

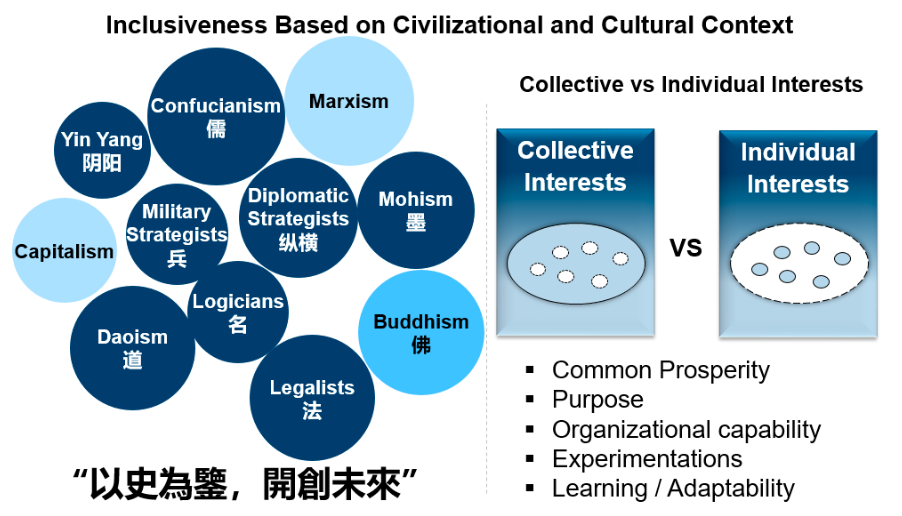

Along the way, MNCs came to realize that China is not simply another “foreign market” where they could simply replicate everything they had been and were doing elsewhere in the world. It is different. Not only was China evolving fast, the Chinese seemed to do things somewhat differently. While it had a large state economy, its private sector was growing fast. As the governments, both at the central and local levels, played significant roles in driving policies and regulations, they seemed to be able to (largely) synchronize with the business sector. While ensuring collective interests is an imperative in China, the nation also embraces a market economy. Against the backdrop of a 5,000 years old civilization, China’s reform and opening up began only slightly more than four decades ago. During this time, China’s paths to growth have been epitomized by numerous experiments from which the Chinese learned and adapted. In initial years of reform and opening up, the Chinese often started off by imitating Western ways of running business and technology. Eventually, they were able to turn the corner to become innovative in their own right, after crossing a certain threshold in evolution of the economy. China’s context and complexity evolved in its own unique way and this added new dimensions to ways of doing business that the Western MNCs (and the Chinese themselves) had not seen before.

MNCs began to comprehend that they couldn’t deal with China in the same way as they were operating elsewhere in the world. Increasingly, MNC executives began to recognize patterns such as China’s speed, agility and an ability to marshal resources holistically, and in the case of private sector companies, their willingness to have an entrepreneurial approach.

Nonetheless, some people’s tendency to either overly simplify its characterization of China, or underestimate the capabilities of the Chinese, or overly bloat the Chinese achievements hasn’t been fully obliterated.

For a long time, mainstream media outlets and pundits have asserted that China offers an unfair and difficult environment to MNCs. They said MNCs found it hard to succeed in China because of reasons such as state subsidies, unfair competition, favoritism for “local champions” and theft of intellectual properties. They would also say in many cases, foreign companies were denied access to the Chinese market (in an unjustified manner). And, some pundits would say MNCs are not welcome by the Chinese government and will not be allowed to stay in the long-term.

To be fair, some of these accusations were not entirely untrue but to assume that the Chinese government created the majority of these “problems” in a systematic way or is the only country that deploys these practices is also probably unfair.

Many MNCs have reaped significant profits from their China operations over the years. Often in a given sector, some MNCs have done very well, while some others have done very poorly. Failure of some MNCs to find success in China was not necessarily due to what some parts of the global media reported. Rather, it was their inadequate ability to anticipate and interpret the macro situation in China, especially its policies and regulations, and to keep up with the rapidly evolving nature of the Chinese customers’ preferences, as well as the increasingly intense local competition. More fundamentally, it was an inadequate understanding of how and why the “China Model” works (see Exhibit 1).

Exhibit 1

Modernity with Chinese characteristics

Source: Gao Feng analysis

While a large number of MNCs have reaped substantial profits from being in China over the years, many of them felt that they could achieve even more in China. Many have felt bewildered and tried to figure out why they couldn’t capture the “rightful potential” that China offered to them.

Over the years, many consultants, academics and the like have come up with simple notions about doing business in China. They would say, “Chinese care about face”, “you should hold your business card with two hands” and “a contract is only the starting point for negotiations,” etc. These simplistic notions are not necessarily wrong but when viewed as a whole, they are not entirely right either. Or, they don’t imply a definitional difference. Worse, they give MNC business executives the impression that the environment for doing business in China is really strange, superficial or unduly difficult. Or, all of the above. Or, they give MNC managers an easy way to justify why things didn’t work out for them in China without truly reflecting on whether there were other reasons.

Unfortunately, this sort of advice has often resulted in MNC executives’ failure to comprehend the fundamental nature of the right ways of doing business in China. They have failed to acquire the needed awareness and the ability to develop the right perspectives and approach for capturing value in this immensely large and growing market.

Worse, some pundits often disseminate wrong information. It is not uncommon for them to spread negative sentiments about foreign companies doing business in China, even as the companies that they themselves work for are doubling down in China.

Or, some would say that China’s innovations were not “good innovations” because they were not cutting edge. However, more often than not, China’s innovations have advanced rapidly in a short span of time through quick cycles of development, achieving leading status in the world in many cases.

For long, MNCs’ fundamental challenges in doing business in China have been in the following areas:

1. Lack of a proper strategic framework to fully characterize China. Strategy frameworks initially borrowed from the West were able to fully address some of the issues in China but were not sufficient to address new dimensions of business that the emerging China brought along.

2. Gap in awareness and understanding of what may be coming and implications of that to the company’s business.

3. As a corollary to 2 above, a tendency to discount China’s ability to innovate and the speed and intensity of impact of China’s innovations on businesses.

4. An inadequate appreciation and interpretation of China’s governance model, which is different from the West and is often smeared by political rhetoric.

5. As a corollary to 4 above, a view of China that is overly fixated on outdated and perhaps incomplete knowledge and information, often leading to underappreciation of China’s ability to adjust and change through experimentation as it navigates the changing local and global context.

More Reflections

Over time, the best performing MNCs began to recognize (some of) the above-mentioned trajectories and phenomena, and began to shift attitudes and strategies. Many have begun to localize their China teams, moving R&D to China, sending seasoned executives from other parts of the world to China for support and paying much more attention to local competitors. Some of these moves are strategic while many are simply blocking and tackling. Nonetheless on the whole, many MNCs are beginning to recognize ways of effectively exploiting the China opportunity (and facing the challenge).

Along the way, factors that MNCs consider when formulating their China strategies have also kept evolving with a shift toward exploring the more fundamental elements of strategic considerations:

1. A deeper understanding and interpretation of the China context, the global context and China’s role in the world.

2. Geopolitics has become a much greater consideration, when developing a China strategy.

3. Greater appreciation of effectiveness of the Chinese governance model, going beyond political rhetoric and understanding how that is evolving as a critical factor.

4. Ability to recognize emerging patterns with respect to industry, products and business models in advance.

5. Innovation in China continues to evolve and intensify, and it keeps disrupting industries. Also, China is shifting fast from being a follower of other people’s standards to an entrepreneurial community that sets standards for itself as well as others. New lanes of sectoral development are being created.

6. Not only think about “China for China” but also markets beyond China with China being the lynchpin.

The Age of Mega Changes

Pessimists say MNCs have little chance to succeed in China and that they should get out. Pundits say that China is playing an unfair game with MNCs and that its geopolitical positioning will become unsustainable. Some even assert that the Chinese feel that they are being “bullied” by the West, so Western MNCs should not invest in China.

Source: Google

Despite the mixed performance of MNCs operating in China, the nation continues to offer major opportunities to those who are in the right sectors and understand the need to build a strong position there. In many cases, a strong position in China often means a strong position in global markets too. It is true that Chinese consumers are gravitating more toward local brands. However, that is primarily because domestic companies have successfully upgraded their products and strengthened their brand equities. It would be incorrect to assert that there is general nationalism-driven discrimination against foreign brands (unless of course, the Chinese feel that certain foreign brands have failed to respect the nation’s legitimate core position, as in the case of “Xinjiang cotton”). In general, Chinese consumers continue to have strong affinity to and respect for foreign brands who know how to resonate with the Chinese people. In my view, MNCs can capture the rightful potential that China offers but it will require the necessary strategic mindset and thinking skills, and meticulous implementation capability.

With the pandemic, the Ukraine War and other global geopolitical developments, we have now entered into an “Era of Mega Changes.” MNCs doing business in and with China are wondering more than ever before what they should do next.

Some have perhaps figured that they can’t effectively compete in the China market anymore, and so they would downsize their operations here or simply withdraw outright. For some others, their China business continues to do well, at least relative to their businesses in other parts of the world. However, some such as those in the semiconductor industry are seeing their global businesses (with China being at the core of it) being shredded apart by geopolitics, which is twisting the fundamental business logic and leading to greater complexities. Yet uncertainties in global dynamics are leading some to wait, at least for now.

Some others see China becoming even more important as a market or a hub of global supply chains or a source of cutting-edge innovations. Leaders of MNCs in this situation see through rhetoric and understand the fundamentals of their own business much better. They would continue to invest in China despite the uncertainties in the general macro environment. MNCs in industries such as electric vehicles, renewable energy, sustainability, “intelligent manufacturing” and advanced medical devices come to mind in this context.

So, the perspective of any MNC in China really depends on the specific industry segment and the company itself. I don’t think any broad brush can paint the real complexity of the situation. MNCs’ views on the future of China also vary. Some are pessimistic while some are optimistic and some are unsure.

The Chinese government has made it clear multiple times that it wants foreign companies to continue to invest in China and that it will strive to create an increasingly better environment for foreign companies to operate in. After all, this is the spirit that China set out to build since the start of the reform and opening up. Of course, there is always room for improvement but the Chinese government’s commitment and will are clear and consistent.

Real strategists will take a clear-headed view and will look for ways to create value while recognizing the risks along the way. They will see China emerging as a platform where the best strategic thinking is needed since China strategy influences how their businesses in the rest of the world would evolve. They also recognize how China is expanding the dimensions of business and therefore any proper strategic thinking must be concomitant with that. As such, they would ask themselves a series of questions:

1. How will China’s context continue to evolve and how will China’s role in the world impact how businesses need to think about strategy?

2. How will the global geopolitics evolve and what will the future world order look like? How would that impact China and companies doing business in and with China?

3. To what extent will “decoupling” (or recoupling) manifest in my industry? And, how will dynamics of the “globalization” versus “de-globalization” interplay evolve over time?

4. How will my industry in China evolve as a result of the country’s policy and technological developments and changes in demand patterns?

5. As a corollary to 4 above, how will innovation in China manifest itself and how will my industry be shaped by it?

6. How will the competitive landscape in my industry evolve along the way? What kind of new competitors will emerge when and how will they compete with the incumbents? What will the structure of my industry look like 5 or 10 years from now?

7. What capabilities will my company need to develop in order to cope with the emerging new competition? How should I think about establishing new corporate relationships with other business (and non–business) entities?

8. How can I best position myself for success in the future?

China has presented an intellectual challenge for many businesses over the last several decades. In the “Era of Mega Changes”, these challenges are heightened even more. The continued development of China in the midst of a quickly changing macro environment means that strategists must adopt a non-linear, multi-dimensional and discontinuous mindset.

Sophisticated thinking taking into account the broader contextual changes will become a prerequisite for the strategists. An ability to link causes and effects across multiple dimensions in a stochastic manner will be required. They will need to discern rhetoric that twists business logic (hopefully only temporarily) and noises that work against sound business fundamentals. Sometimes, they shall need to put strategy into a context of “option plays” against the backdrop of how future scenarios may evolve and manifest. They should be willing to accept ambiguities and yet be able to identify both the upside as well as the risks involved. For those who get it, China will continue to offer game–changing potential that could generate unparalleled economic and strategic value, be it the core of one’s global strategy or inspirations for innovation.

If one takes a medium and longer-term global view and embrace business fundamentals and logic (sieving away the white noise along the way), one could (re-)imagine how China will become pivotal in the world, particularly in sectors that matter, such as technology, digital, finance and fintech, cross-border ecommerce, auto-mobility/new energy vehicles, semiconductor, sustainability, health care, advanced manufacturing, precision equipment, data storage, computing and security, and others (see Exhibit 2). However, amid the current uncertain and volatile macro environment, you need to ask how should you play the China game smartly.

Exhibit 2

Key sectors in which China plays an indispensable role

Source: Gao Feng analysis

China is bringing to fore additional dimensions of doing business that companies haven’t seen before. It presents both profound opportunities and also certain risks. While there is a plethora of moving parts, if one looks carefully, there is also a set of underlying principles that don’t change (much) with time and space. Discerning all this will require the best strategic minds.

About the Author

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong, Professor of Managerial Practice at Cheung Kong Graduate School of Business, and Adjunct Professor at the SPACE program of University of Hong Kong. He is a member of Global Future Council on China at the World Economic Forum, as well as a member of advisory boards for private equity and venture capital companies. He started his strategy consulting career at McKinsey’s San Francisco office in 1988 before returning to Greater China in the early 1990’s. He became one of the pioneers in China’s management consulting industry, by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He has also advised the Chinese government organizations at different levels on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as the newly published 《变局思维》(Strategic Thinking in the Era of Mega Changes) (2022). He holds a SM and a SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司