GF Viewpoint | What is CBDC and How Will it Shape China's Position in the World?

GF Viewpoint | What is CBDC and How Will it Shape China's Position in the World?

An Interview with Richard Turrin

June 2022

Preface

On June 14, 2022, I had a dialogue with Richard Turrin, a best-selling author and a fintech, innovation and AI consultant. In this dialogue, we discussed what is a CBDC and how will it shape China's position in the world.

Edward Tse (hereinafter Ed): Today, on this show, I'm very delighted to have a real expert in fintech, especially in digital payments, Richard Turrin.

Richard is a best-selling author and also a consultant in fintech, innovation and artificial intelligence (AI). I came to know Richard when I ran into his very popular best-selling book Cashless. He is very well known. Richard is in my view by far the most valued expert in the area of digital payments, particularly in Central Bank Digital Currency (CBDC).

The topic of our discussion today is CBDC. Richard, in addition to being the author of best-selling books, you have had an illustrious career in professional services. Perhaps you can introduce yourself in greater detail to our audience.

Richard Turrin (hereinafter Rich): Sure, Ed, you are too kind with your introduction. I spent 18 years in investment banking, working on a trading floor and designing structured products. I worked in exotic derivatives, including earthquakes, hurricane bonds, and catastrophic insurance type of bonds. The thing that's relevant to my book on CBDC is that they were all in this intersection of money and computers. That's really where we're going - this digital world and the use of CBDC. Like it or not, money is going digital. You can fight about how digital, or how you want it to go digital, but it's happening all around us.

I was a hardcore banker for years and then I did 5 years with IBM, both of which were mostly here in China. Again, banking and computers were put together and that's how I spent most of my life, figuring out how to make money work on computers.

Ed: You live in Shanghai, right? How long have you been living in Shanghai?

Rich: I have lived and been here for 12 years now and that is the reason why in my book Cashless, I talk about transformation of China into a cashless society. The first time I had to pay a big security deposit on an apartment in Shanghai, I had to go to the bank and get bricks of hundred RMB notes to pay for the first month's rent and two months’ rent as security. You literally needed a duffle bag.

That's all gone now. Everything is done on WeChat Pay and Alipay, and we're all cashless. I have witnessed and lived through this transition from one always having a big block of cash hanging around the house to carrying money on one’s mobile phone which is the easiest way to pay for stuff.

Ed: I have also been working in Shanghai and other parts of China like Beijing and other cities for over 30 years. And I totally agree with your personal experiences. I think if people just observe China from a long distance without having been to China or are just visiting China for short periods of time, it's very difficult to get the feel of the real situation and developments here.

Rich: Let me give you an example of where it's real. There are many people who read about WeChat Pay and Alipay in the West. It's very common for them to say that I have a Visa or Mastercard, or I have Google Pay, Apple Pay on my phone, and I tap to pay. What's the difference?

It's really hard to explain to somebody who's never seen the Alipay or the WeChat ecosystem with insurance, investments, and all these different features. It's so vast. But they just see it as a payment thing. China uses QR codes and the West uses tap. It's very hard for them to imagine what's going on behind the scenes. I see the commentators and I read their stuff, and clearly, they've never been to China.

Ed: So, Rich, today is a good occasion for you to share with us your firsthand experience and your expertise. I think your book is really powerful. So, I would recommend your book to anyone who's interested in the topic of digital currencies and the rise of China in this area. This is a must-read book and I would recommend it. Since we are talking about the CBDC, what is it actually?

Rich: Yeah, it looks like we got to start from the real beginning, and then we'll build on it like building blocks. The first thing to understand CBDC is that it is not cryptocurrency.

A CBDC is a digital version of a currency like dollar, renminbi, euro, etc. It owes its existence to cryptocurrency. So, the technologies that Bitcoin and other cryptos use were co-opted, borrowed or some may say, stolen by central banks to build a new form of money.

Ed: But what is CBDC actually? How do you define that? What is money in digital form?

Rich: First thing is that, it is a digital currency issued by the central bank, just like your bank notes are issued by the treasury or through the central bank, whatever. And, what is a digital form of money? I’m going to explain what's called tokenized money. For example, here it’s a 100 RMB note, we can take that and put it into a digital form on your phone.

We take the basic technologies of cryptocurrency, which means the concept of cryptographic hashing. We cryptographically hide this currency, but the most important thing is that it takes away the need for an account.

Let's just imagine we're using WeChat right now. If I say I’m going to send you 100 RMB on WeChat, I go to my phone, open it up, send you the 100 RMB and it transfers the money. It's great. But it has to go through WeChat, a third-party provider, to pay you. It's the same in the West. If you use Apple Pay, you have to use the Apple ecosystem. Now with CBDC, we're going to have the ability to have digital money that lives on our phones. If I pay you 100 RMB it is a digital string of 100 RMB going from my phone directly to yours with no third-party intermediary. And that's the big thing. We are leaving behind a world that is based on bank accounts - I have a box, I have money in the box, and we put the money in and take it out, even if it's digital.

We leave that world and we're going into a world where the money is actually digital. So, when I send it, I can make payment directly, which is a disruptive technology. Visa, Mastercard, Apple Pay, WeChat Pay or Alipay are not going to go out of business, but fundamentally, one party will be able to send money to another without an intermediary. That's exactly what the Bitcoin revolution is about - they want no government involved. However, we are going to have the government no doubt. That's a major part, or one of the major benefits of crypto that is being brought to the fiat currency world.

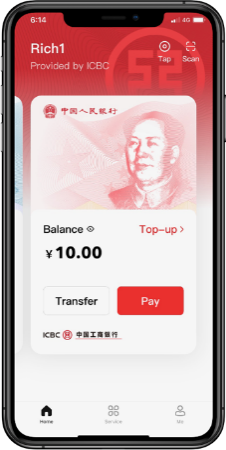

Ed: Literally, there's a wallet of digital money embedded in your smartphone. Is that right?

Rich: That is 100% correct. So, when I open WeChat now and it shows I have 100 RMB in my WeChat account. The money is actually in an account in WeChat. It's not on my phone. But when I actually open my China digital RMB app, which I have on my phone, it says I have 100 RMB that lives and sits on my phone. So, the big difference is that both are digital payments but one is an account based digital system and the other is the tokenized system where we take money and turn it into this concept of a digital token. I can give the token to you. We can trade. It's a remarkable technology.

Ed: Aside from the fact that you don't need to go through a third-party, and you can transact directly, what other benefits does it provide?

Rich: The first thing to understand CBDC is that it is not cryptocurrency. That’s a big deal because when we talk about payments in the banking system, I can’t say about China in particular but it is likely that most of the world will go for free transactions, meaning that the cost of payments from me to you is zero. Free and immediate payment is a big benefit.

Other benefits are really societal benefits, which is mostly about financial inclusion. If you look at China, there is a large unbanked population, and digital money will give them the ability to save digitally and access financial services digitally without having to put money under mattresses.

That's a real issue throughout the developing world, not just China, but also throughout Southeast Asia. So, with the help of CBDC, we're bringing in financial inclusion, besides ensuring fast payments sans transaction costs.

We’re also getting programmable money, meaning that money can now do more. However, this is controversial. Some people are very concerned about this. Through the programmable money, the government can create money and give to a group of people to stimulate the economic demand. For example, in Shenzhen, they came out with a lottery system and gave a couple of hundreds of RMB to people who will use it to buy things. You have to use the money on Meituan, an e-commerce platform, and you can't put the money in your bank. Now, you may ask who puts stimulus checks or money in the bank? Actually, about 20 percent of Americans took the thousands of dollars they got as stimulus and put them directly in the bank, meaning the dollars didn’t stimulate much.

The programmable money is particularly useful for assistance or aid payments. We want to make sure that if people get money from the government, they spend it, so that it could stimulate economic demand. We also want to make sure it's not spent on alcohol or guns as in the United States. With programmable money, we can limit the ways it can be used. So, the programmable money could be good or bad. People say they hate programmable money, but actually, it already exists, particularly in the US and the EU. Those are some of the big advances of CBDC - programmable, financial inclusion, lowering the cost of payments and immediacy of payments. These are the big ones that you read about over and over again.

Ed: I also heard some people criticizing the potential downside because it's related to the central bank, i.e., the government. They say you're always under surveillance, if you use the CBDC. Is that right? Should people be concerned about that?

Rich: Let me make a broad statement to make it easy for people. You should be concerned about this, but you should not be afraid of this. CBDCs are software. You can build good software and you can build bad software.

The accusation is always the same. China's CBDC, the digital Yuan or the digital RMB is nothing more than spyware or spy software. And the answer is really funny. China’s CBDC offers greater privacy and anonymity than credit cards or other forms of digital payment used in the West, including Visa and Mastercard.

The Chinese digital currency is completely anonymous for payments of up to around 300 USD. Let me pose the following questions to all the listeners. You go to Starbucks, buy a coffee, and use a Visa or Mastercard or other digital payments mechanism. What guarantee or what expectation of anonymity do you have when you tap or swipe your card? The answer should be zero, because as soon as you use that digital card, it got your name on it. So Starbucks would know your information.

Now, that anonymity may change when it goes through this payment system. As long as the payment goes directly to Starbucks, they know who you are, right? Now I’ve got a system in China in which I can have complete anonymity when I pay an amount of up to USD 300. That's better than the Visa and Mastercard system. It's also better than WeChat Pay and Alipay, where like Western credit cards, there is no presumption of anonymity.

Not a day goes by when I don't read really horrible stuff about China’s digital RMB. And the concept is that it is the worst thing, it is a spy, it's terrible. However, the reality is that it is anonymous up to 300 USD and nothing in the US has anything similar. If you tell me you are anonymous when you use cash, that's a different situation. And I agree, cash is the most anonymous thing. We should be concerned about it because it’s quick, dirty and easy.

If you look at the European Digital Euro project, or the Digital Dollar project in the US, we are not clear of the exact design yet. But the hints that we're getting are that both the European Central Bank and the Federal Reserve will likely use versions of CBDCs, where the central bank has no idea and does not have a database of any of your personal details in it.

Therefore, if the Federal Reserve or the US government, or the European government doesn't have this data with your name on it, how do they know who you are? It's simple. They go to a judge, get a warrant, and then they can unmask you. That's the same process as tracking someone who uses credit cards and bank accounts today.

I understand that people are afraid as they may have read terrifying things, but it just isn't true. This is software. We can make and build privacy in there changed at your end. It won't be perfect. It won't keep everyone happy. But it will be more private than credit cards and the digital payment systems that you have in the West today.

Ed: If the money is digital, it’s based on software, and it’s programmable, it could actually, in theory, expire, right? How can I make sure that my money won't be spent by someone else?

Rich: People are afraid that if the money is programmable, the government can cancel my money. However, the fact is that CBDC does not have super powers. If you are a suspected criminal or are evading taxes, the government would cancel your bank accounts and your credit cards immediately. They can do that, but they have to go to a judge to do that. That is the same system that we're going to have with CBDC.

There was a big trucker strike in Canada a few months ago. The Canadian government cancelled the actual bank accounts of the truckers, and that was a terrible thing.

I’m not saying it's good, but what I’m trying to show you is that you live a digital lifestyle today, you've got digital accounts and your money isn't in a wooden box in the bank. If the government has reason to shut you down because you haven't paid taxes or they suspect you of being a criminal or something else, they go to the court, get an order from a judge, and go to the bank. Then the bank hits a button and shuts off the system. Basically, there is no difference between that system and a CBDC system.

Ed: So, in a way, we are already living in that world. You're saying that there won't be any material changes going forward, right?

Rich: We are in that world right now. It's just that most people don't think much about it, because it doesn't happen that often for most of us. It's a very distant thought.

Ed: You also mentioned Alipay and WeChat Pay, right? For those of us who live in China, we know the impact of Alipay and WeChat Pay in our daily lives. Everybody is using online payments one way or another in China. Cash has essentially disappeared. Essentially it is gone. So CBDC, Alipay and WeChat Pay, how would they influence one another going forward?

Rich: It's very common to hear two things in the West. The first is that China’s central bank has built the CBDC or the digital Yuan in order to punish Alipay and WeChat Pay. That is objectively not true. And let me give you a very simple answer. The digital currency research institute, which is behind the digital Yuan, was founded in December 2013, when both WeChat and Alipay had just come into existence.

So, the digital currency, the concept of a digital Yuan, goes all the way back to the time when WeChat and Alipay started. So please don't think of the digital Yuan as a means of somehow punishing or destroying WeChat or Alipay.

The second thing is that the CBDC is going to kill Visa, Mastercard, WeChat Pay, Alipay and cryptocurrencies. In fact, CBDC will live peacefully with WeChat Pay and Alipay in China and with Visa and Mastercard in the West. It’s unlikely that people who love crypto hate fiat, so one is going to eliminate the other.

In China, you've got a very unique situation where WeChat Pay and Alipay have these tremendously large platforms, which are really convenient to use. That’s what we call user stickiness. Once people start using them, they don't want to leave. You will be able to use the CBDC or the digital Yuan on WeChat and Alipay. I already can on my Alipay in particular. If you receive salary in digital Yuan, which is starting to happen in a few trial zones, you can spend your salary through Alipay to buy things you want.

It is not realistic to think that suddenly all of these people are going to move from WeChat and Alipay to digital Yuan. They're all free. They all work very well.

So, CBDC is not going to kill the others, like Visa and Mastercard in the West. You could pick the payment channel depending on what you want. If you still want to get points on your Visa and Mastercard, you could use your card to buy something. If the retailer says, I’ll give you a discount if you pay by CBDC, you'll use that. If you're on WeChat Pay and Alipay, they will also give loyalty points for frequent buyers or frequent flyers. If those mean something to you, you'll stick with them. So, you could pay in different ways that suit your needs.

Specifically for the China market, when people start receiving salaries in digital Yuan, which is going to happen as it's already being tested, this is where WeChat Pay and Alipay were never designed to go. They were never designed for a larger scale, high volume payment system. Once that happens, people will have access to even more digital money, meaning they will spend even more digital money through WeChat Pay and Alipay platforms.

So even if it's not on Alipay, sales and other transactions on the platform are going to go through the roof. It's going to be really dramatic.

Ed: That's going to have profound impact on these kind of online payment systems. They are going to benefit from these transactions from what I see. The other question is what a lot of people are talking about these days. Because of what's going on in Europe with Ukraine, whether CBDC can help evade the sanctions? Would China’s CBDC drive the de-dollarization process? How would the system shift, going forward? If it sustains, is it still going to be prevalent, or is it going to be marginalized? What's going to happen to CIPS (Cross-Border Interbank Payment System), the Chinese cross-border payment system, and so on? There's a whole grey area that has been arising because of the war in Ukraine. Could you just quickly go through what you think about it?

Rich: Sure, let's make something very, very clear. Even the US government has come out with a comment that said, China has not assisted Russia with CBDC. It has not assisted its financial system with the UnionPay Credit Card system. Some people had speculated that China would help Russia after the Visa and Mastercard cutoff. The third thing is CIPS which is a SWIFT alternative in some ways. China has made no significant effort to assist Russia with any of these payment platforms, partially out of fear of sanctions from the US or EU. Now, specifically about CBDC, the digital Yuan is far too new and has not been launched in China yet for full domestic use. So, the probability of using the digital currency for helping Russia in any meaningful way is just not there. It's not technologically advanced enough.

But this year, both India and Russia are launching their own CBDC pilots. When China and India both fully launch their own CBDCs, 37% of the world's population will have access to a CBDC. Now, add Russia to that. If we wait two years for these systems to develop, I think we're going to see something very different happen with trade.

It's not here yet, but I heard it from a guy on his podcast first. The next two to three years in the future, India, Russia, and China will have CBDCs and it's foolish to believe that they're not going to use them.

Ed: Rich, since you and I are consultants to companies, and in your case, you know a lot of startups too, what would be your advice in general? Let's say you are talking to the CEO of a large American company, who has been doing business in China for a long time. They have been doing very well in China and China has become one of their largest markets. And obviously, the CEO will be concerned about many things such as the market conditions, the supply chains, customers, products, R&D capabilities and so on. But on CBDC or the general area of China's fintech, how would you advise a global CEO of a large American company on how he or she should be thinking about it?

Rich: The answer is very clear - It is good. For any CEO who has China operations, China's CBDC will become legal tender, so there is no way to refuse it. It’s no doubt that your company will have to use it. Your treasury in China will be using CBDC.

Now, what's going to be interesting for your treasury is that CBDC will be used for large scale payments of over 100,000 USD. Remember I said digital Yuan goes places where Alipay and WeChat Pay were never designed to go? This is a good example. What you're going to see is large volume, large scale payments within China made by CBDC, which is fast, free, cheaper than the existing banking systems. It’s good for both import and export. You must be aware of what is going to happen with China’s digital Yuan, customs clearance, and digital logistics in and out of China.

China's digital Yuan is not just a payment system. Most economists are completely missing this. They talk about “I like RMB”, “I don't like RMB”, “I don't trust RMB” or whatever. What they are missing is that using digital RMB will give you access to a digital customs clearance system, a digital logistic system so that you will be able to literally watch your products come off the production line, put into the container, and then you watch that container go all the way to the port and go through a digital customs channel.

You may say that's years away. No, it exists now. Anybody, particularly one who's a CEO in Hong Kong, already has access to these blockchain trade systems between the Mainland and Hong Kong or Macao. They're real. They operate today, not with digital currency yet, but it's coming.

These blockchain systems are already taking days off customs clearance and about a percentage point off of trade finance transactions done with major Chinese banks. So don't look at this as something that is far away in the future. No, it's here today.

So, think of the digital currency in China not just as a way of making payments. Think of it as a key, a token to access China’s digital logistics system. It's far more.

One final thought and I hear this every day - it depends on your faith in RMB. If you're our age, you may have a little bit of grey hair, learning from the young crypto kids. How much faith do you need to have to use the digital RMB if you can convert dollars to RMB and pay for something within 10 minutes or 5 minutes? This is the digital world. Using the digital RMB depends on how much faith you have. I can be in and out of digital RMB in a matter of minutes in my dual currency bank account. It is fundamentally changing how we think about money. And that's the important idea for CEOs to comprehend.

Ed: Rich, I think you have touched a very important point because a lot of global companies today, by definition, are very concerned about the supply chain security, given what has happened in China and particularly in Shanghai, where you live actually, about the pandemic lockdowns, the war in Ukraine, and all the stuff people are talking about. Can we still trust China as the hub of global supply chains? How should we think about this?

What you're saying is that, in fact, despite what's going on with the pandemic, the war and so on, China is actually taking off on another path, which is digitizing the entire supply chain from end to end. And that capability is, I would say, from what you just described, China is really at the cutting edge of that, right? Integrating CBDC and supply chain together makes it a very powerful, competitive advantage for China, knowing what's going on in the market in China today and in the future. Therefore, CBDC actually will become at least a somewhat important factor of consideration for global CEOs when they think about their global manufacturing footprints. Where they should place their manufacturing, the supply chain, and all that kind of stuff?

Right now, there's a lot of talk about let’s find a way to go to Vietnam, India and other places, which I think, in some cases, makes sense, but in some others, it may not, given what you said. What's your view on that?

Rich: What China is doing in supply chains is flying under the radar. I get that supply chain is a big deal especially because of the lockdowns. It's on everybody's radar today. But in general, what's been happening in China, unless you're in the supply chain business or logistics business, otherwise nobody cares. Alibaba is now guaranteeing 3-day shipment to like 30 or 40 countries anywhere on the planet through its Cainiao operation. What they're doing with digital logistics hubs and digital supply chains is mind-blowing. And people are not paying attention.

Maybe for certain companies like Apple, too much of their business may have been concentrated in China. If they want to make iPads in India or someplace else, great. But they are not going to be able to replicate supply chains. The advances that are coming up with China's supply chains in the next 2 to 4 years are going to be mind-blowing. It's just not something that Vietnam or anybody else is going to be able to replicate.

Especially for high-tech, complex manufacturing. Garments and clothes were already on their way to Vietnam a long time ago. But it is very hard to replicate the supply chains for high-tech stuff. There isn’t any place that I think has as competitive a supply chain system as China. Now, you add digital Yuan into that. It's going to be mind-blowing.

Ed: Rich, it's just fantastic insights from you. I know that I've taken a lot of your time. Perhaps I can jump to the last question if you don't mind. I've been doing a lot of cross-border business among Hong Kong, Chinese Mainland, and the rest of the world. In Hong Kong in particular, there's a lot of interest in integrating more of Hong Kong into the Greater Bay Area (GBA). The GBA includes nine cities in the Guangdong province plus Hong Kong and Macao. Nonetheless there are three different jurisdictions from the standpoint of administration. There's a lot of interest from people in Hong Kong to talk about the implications of China's CBDC for finance and the development of the fintech industry in Hong Kong. Again, what would be your recommendation for Hong Kong business people as well as policy makers in the fintech area and how to leverage the benefits of CBDC for development of Hong Kong and its integration with the GBA?

Rich: The first international transfers of China's digital RMB have already taken place and they're all between Hong Kong and Shenzhen, all within the GBA. So, for anybody operating in Hong Kong, the first thing is to look for what's going on with China’s digital RMB, whether your bank or your partner’s bank in the Mainland is doing anything with regard to digital RMB. You would be able to use digital RMB with these blockchain-based trade systems, trade finance, trade customs systems. It's designed for small and medium enterprises (SMEs) as well as the big companies with many millions of dollars trading back and forth. Many of the SMEs are already taking advantage of these blockchain trade finance platforms. And they are going to increase in numbers.

Hong Kong will become the international digital RMB center. The Bank for International Settlements working with the Hong Kong Monetary Authority shall build the first central bank sponsored CBDC transfer exchange center. It means that you will be able to exchange, a digital Hong Kong dollar for other digital currencies within a matter of minutes someday. It's all going to happen in Hong Kong, so you're going to be a part of this. It's going to be in the newspapers, which means it is not a secret. When you see it, be an early adopter and experiment with it early, because the people who get this first will have a decided advantage in financial costs, which may make a really big difference for you and your business.

Ed: That's really fantastic. I would simply close this interview by saying to my audience, anybody who would like to get some real insightful advice on the application of CBDC for their businesses, whether you're a big American or European company or an SME from Hong Kong or whatever, please reach out to Rich. I think you will let people know how to get hold of you, right? How can people get hold of you, Rich?

Rich: Sure, thanks so much, Ed. It is very simple to reach out to me. Go to my website richturrin.com. I have all my interviews and my podcasts there. For my book, please go to Amazon. There is a bunch of other retailers, but Amazon is the easiest way to buy it. I'm also on Twitter and LinkedIn. Join the discussion if you are interested. I post every day. I talk exactly about the stuff that we just hit today.

I’d love to hear from you. If you disagree with me, write to me, tell me why you disagree. If you listen to my podcast with Ed, I’d love to hear from you. Nothing makes me happier than hearing from happy listeners and I always write back.

Ed: Fantastic. I know that you have a huge number of followers on LinkedIn and Twitter. I follow you religiously. You are on LinkedIn every day and your posts are insightful and very sensible. I would highly recommend anybody who is interested in the topics of crypto, CBDC, or cashless payments to visit Rich’s LinkedIn, and Twitter account as well. Follow him.

Thank you very much, Rich. I've taken a lot of your time, but your inputs have been incredibly insightful and helpful. And I know that many of my clients would appreciate your inputs very much, which will make them think. We may have a chance to work together.

Rich: Thanks, Ed. I am looking forward to that day.

Ed: Thank you, have a nice day.

About the Interviewee

Richard Turrin is the international best-selling author of “Cashless - China’s Digital Currency Revolution” and “Innovation Lab Excellence.” He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand and has a unique combination of banking and technology skills that allow him to bring the exciting story to life. Rich is an independent consultant whose views on China’s astounding fintech developments are widely sought by international media and private clients.

About the Interviewer

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong, Professor of Managerial Practice at Cheung Kong Graduate School of Business, and Adjunct Professor at the SPACE program of University of Hong Kong. He is a member of Global Future Council on China at the World Economic Forum, as well as a member of advisory boards for private equity and venture capital companies. He started his strategy consulting career at McKinsey’s San Francisco office in 1988 before returning to Greater China in the early 1990’s. He became one of the pioneers in China’s management consulting industry, by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He has also advised the Chinese government organizations at different levels on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020). He holds a SM and a SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司