Why Strategic Thinking is Important For Global Companies Operating in China?

Why Strategic Thinking is Important For Global Companies Operating in China?

By Edward Tse

February 2022

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse. With China’s strategic importance to global companies and given the quickly evolving context of China and China in the world, managers for multinational companies operating in China need to possess adequate level of strategic thinking.

These days, China is top-of-mind for a large number of multinational companies (MNCs). Despite the pandemic, geopolitical tensions, supply chain disruptions and other negative factors, China continues to be at the epicenter of the business portfolio for many major global companies. Foreign direct investment (FDI) reached US$100.74 billion between January and July 2021, up 30.9% year-on-year, surpassing the US, making China the top receiver of FDI in the world. Moreover, according to the 2021 China Business Report by the American Chamber of Commerce (Shanghai), over 80% of surveyed companies expect revenues in China to rise in 2021 and expect growth levels in 2021 to return to pre-US-China trade war levels.

The scale, complexity, speed and intensity of change, as well as the rapidly evolving role of China in the world have led many MNCs to look beyond their normal areas of familiarity. More fundamentally, the evolving governance system comprising both top-down state planning and a vibrant business sector, often bridged by capable and resourceful local governments, has created a very unique governance approach. Developed against the backdrop of an ancient civilization and culture, this approach created a very unique context that very few MNCs, if any, were able to understand and appreciate when they entered the China market. China’s governance approach is also evolving over time as it searches for and advances its own definition of modernity while dynamically striking the right balance across multiple dimensions of its national priorities.

The Evolving China Context

China offers MNCs additional dimensions of business they have generally not seen before. When the MNCs first entered China, they thought they could simply plug and play what they did in other parts of the world. To be fair, some of these attempts did work to some extent, for a while. However, MNCs soon began to feel the presence of the additional dimensions that manifested in China and realized they needed to adjust.

The China context is epitomized by the changing policies, technology and demand patterns. Beijing’s policies often lead to new directions and priorities for the country, creating new opportunities for businesses and investors alike. Technology plays a major and omnipresent role in China these days and is an enabler for businesses and entrepreneurs to innovate and develop new business models. As such, demand patterns in China are changing rapidly not only due to new policies or new technologies, but also due to shifting demographics, lifestyle pursuits as well as brand preferences.

These drivers are generally multi-dimensional and often manifest themselves in a discontinuous manner. As the markets expanded, Chinese competitors emerged across the board and in many cases, they are now serious competitors to foreign MNCs. In some sectors such as e-commerce, online payments and logistics, Chinese players have taken dominant positions.

In the past, Chinese companies had strong positions only in a limited number of sectors. Many of these were state-owned enterprises which were endowed with preferential conditions. As China continues to deregulate the market and allows greater access to foreign companies, this phenomenon is gradually reducing. In open sectors, Chinese companies have exhibited strengths and capabilities that even some of the marquee Western MNCs find difficult to match.

There are many reasons why that is the case. Perhaps one critical reason is that Chinese companies are usually able to anticipate the forthcoming changes and disruptions brought about by changes in the key drivers well before the MNCs could.

The Third Way

The entire China context needs to be considered when companies think about their strategies.

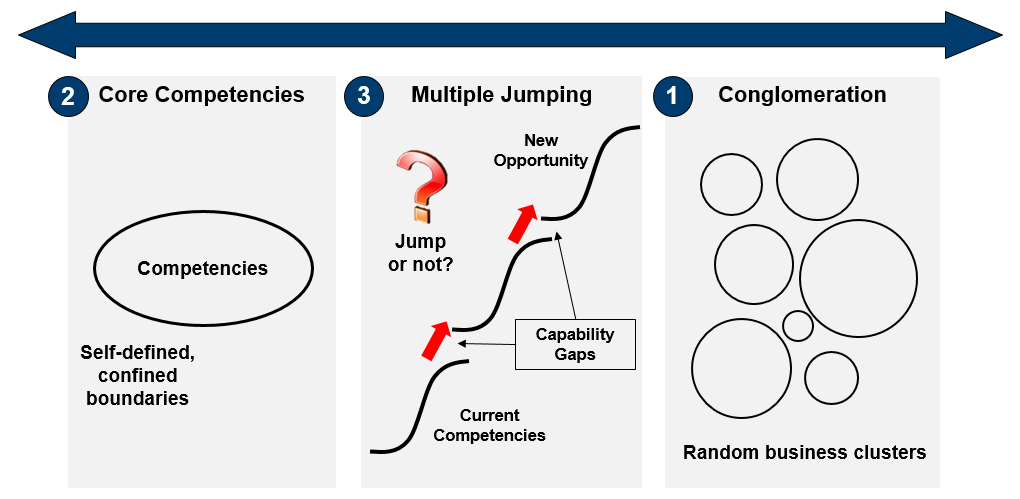

Three decades or more ago, Western corporate strategists had only two ways of thinking about business strategies. One was “diversification”, which meant building conglomerates with portfolios of vast and often unrelated businesses, aiming at capturing opportunities in the external environment. The other was to “focus” only on one’s area of strength, building on the company’s own “core competences”. Since then, the “core competence or capabilities-based strategy” has become the mainstream strategic framework in business, shaping how company executives make strategic decisions and how the capital market evaluates companies. Since the first version of this concept came out in the early 1990’s, various reincarnations of this concept have been offered by various consulting firms and academics for more than two decades.

However, neither of these two concepts can fully explain the corporate growth phenomenon in China (and for some tech companies on the West Coast of the US), especially since some had stepped on their growth gas pedals soon after commercial manifestation of the wireless internet in the 2000’s.

In 2014, I proposed an alternative way of strategy formulation in which companies can go through rounds of “multiple jumps” to leap from an existing situation to a new opportunity even when they don’t have the necessary experience and capabilities. Corporate leaders taking this approach constantly evaluate the attractiveness of the new opportunity versus to what extent they can build the capabilities needed to compete in the new area through either building the capabilities themselves or entering into collaborative partnerships (or “ecosystems”). This is what I call the “Third Way of Strategy” which bridges the theoretical gap between the first two concepts (see Exhibit 1).

Exhibit 1

The “Third Way” of Business Strategy

Source: Gao Feng Advisory Company analysis

While the diversification approach (“The First Way”) focuses on market opportunities and puts little emphasis on consideration of internal capabilities of companies themselves and the “core competence” or capability-based approach (“The Second Way”) focuses on internal capabilities of the company and not much on the external opportunities, the “Third Way” explicitly considers both the opportunities and the company’s internal capabilities.

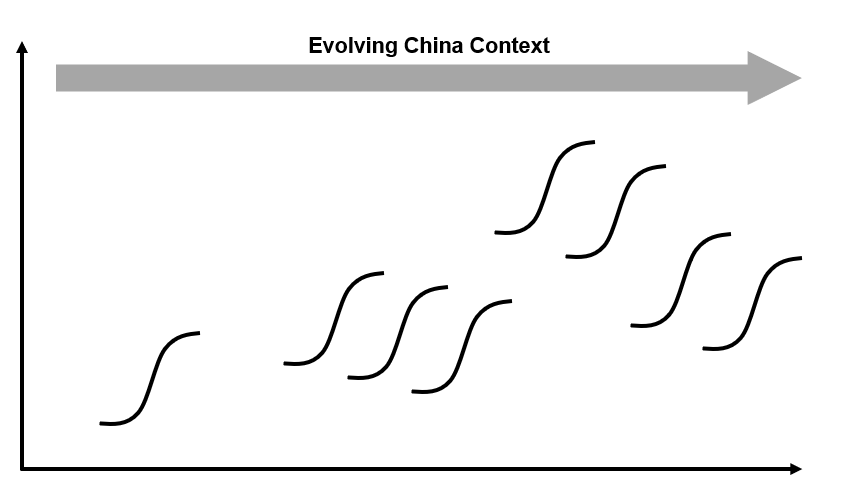

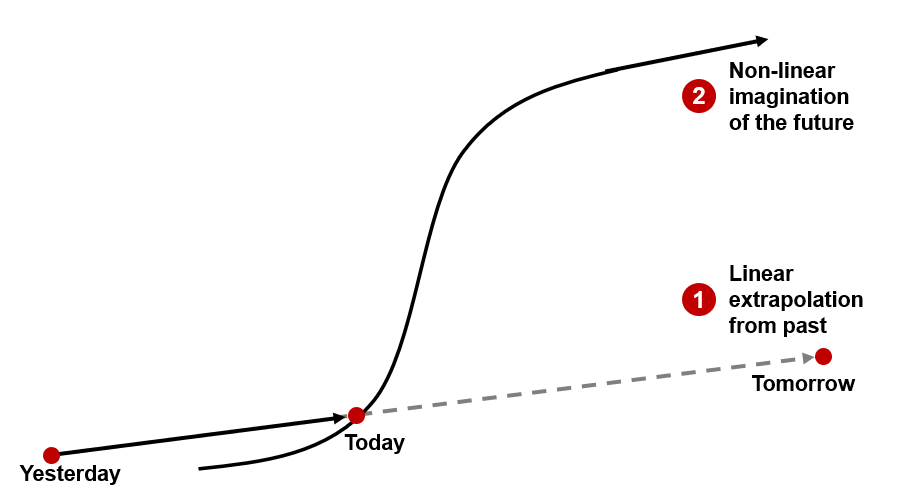

The Third Way has become prevalent as new opportunities emerge rapidly and frequently in China as policies, technology and demand pattern changes evolve, often in a discontinuous and non-linear manner. In fact, very often multiple discontinuities appear in certain market segments at the same time (see Exhibit 2).

Exhibit 2

Multiple Discontinuities Through Time-space

Source: Gao Feng Advisory Company analysis

Through a “multiple jumping” approach, many local companies have crisscrossed from one sector to another by leveraging underlying technologies such as the wireless internet, and now increasingly, artificial intelligence, the internet-of-things, 5G, blockchain and cloud computing, and jump when they see new opportunities. They may not have all the capabilities needed to navigate in the new space but they will try to fill the gaps along the way. They fill part of the capability gaps by building the requisite capabilities themselves, while filling the remaining gaps through collaborative partnerships with others. Some of these multiple-jumping companies have since become large platform companies.

While local companies were often the first to grasp opportunities this way, foreign companies too are beginning to follow the same approach, most notably in internalizing the fact that market development in China is often non-linear, discontinuous and multi-dimensional.

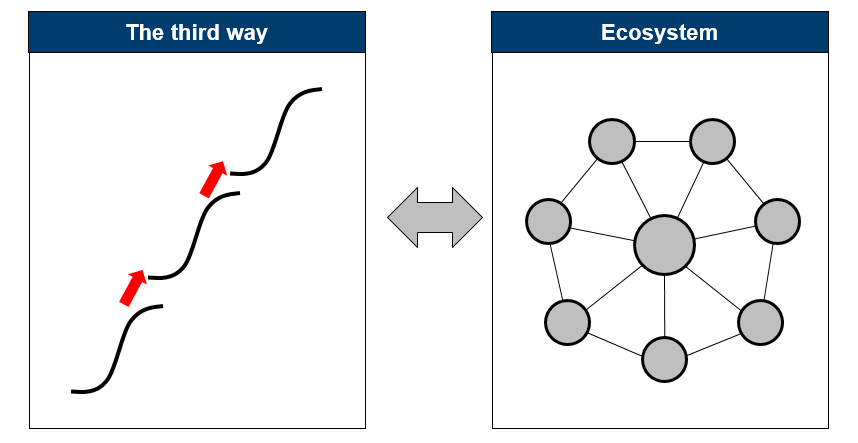

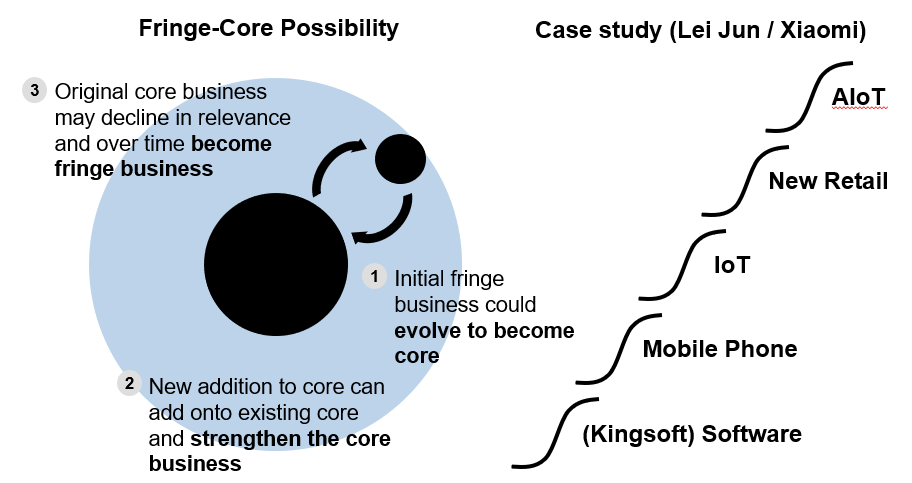

The organizational manifestation of the “Third Way” of business strategy is, therefore, business ecosystems (see Exhibit 3). In other words, business ecosystems are created out of a fundamental need for companies to close these capability gaps as they jump.

Exhibit 3

Ecosystem is the Organizational Manifestation of the Third Way

Source: Gao Feng Advisory Company analysis

Localization? What Localization?

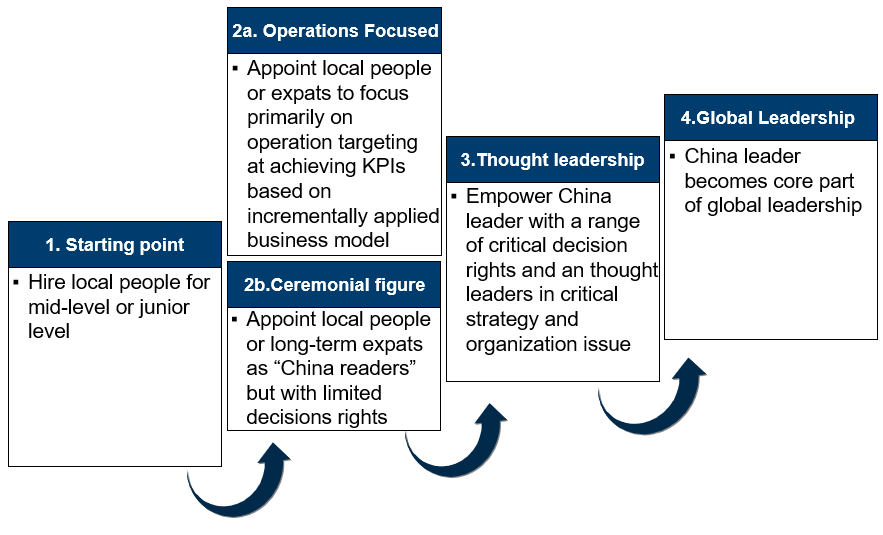

Foreign MNCs have been aware of the need for localization for a long time. Even three decades ago, when I started advising MNCs on how to enter the China market, the MNCs already knew they needed to localize. Their version of localization at that time however, was simply to hire some local people, while the non-locals still controlled the major decision-making, including strategy.

Over time the notion of localization at MNCs has evolved (see Exhibit 4). Many MNCs hire a “Head of China” who is usually someone with a sales or marketing background and his/her priorities are to meet the sales targets usually based on products and business models dictated by their global headquarters. Some multi-business unit companies would designate someone as a “China CEO or Chairman” who usually has no or very little line responsibilities and often is only a figurehead of the company. The focus of this type of “China Head” is to build and upkeep relationships with central and various local governments as well as with Chinese joint venture partners where applicable, besides being the public face of the company in China.

Exhibit 4

The Evolution of Localization

Source: Gao Feng Advisory Company analysis

In neither of these two cases, effectiveness of the local leadership of MNCs in China is ideal. The operations-focused leadership concentrates upon achieving financial targets for the company’s business based on “what was defined and agreed upon.” These managers are typically heads-down, linear, incremental and KPI (key performance indicators) driven. The ceremonial leadership focuses on relationships, events and ceremonies. They may be involved in business at the fringe but certainly not at the core. Their headquarters are also handicapped as they are typically at a distance from China and lack adequate understanding or even familiarity with China’s context.

While numerous MNCs have hired many people on the ground in China and have also transferred a certain number of people from other parts of the world, capability gaps still exist, especially in their ability in interpreting the evolving China context. Many have found they can’t realize their rightful potential from China, not only in terms of revenue or power of their supply chain, but increasingly in the capture of knowledge and expertise derived from China's innovations. Many have been taken by surprise by new policies, new innovations or emergence of new competitors. A simple notion of localization and assignment of some expatriates to China is not sufficient for MNCs to adequately achieve their purpose.

Common Pitfalls

While strategic thinking ability is a key skill for MNCs’ managers in China, not many MNCs have been able to effectively develop this kind of skills in their managers on the ground. Without achieving a basic level of strategic thinking ability, companies can run into a number of common pitfalls.

1. Missing out on discontinuous opportunities (or threats)

As opportunities (and threats) often manifest in a discontinuous manner in China, an operations-focused, linear mindset and approach often miss the boat (see Exhibit 5). While being operations focused is critical in achieving short-term results, the ability to strategically anticipate how and when the next discontinuity would manifest would mean either missing out a new opportunity or a threat.

Exhibit 5

Linear vs Non-linear Mindset

Source: Gao Feng Advisory Company analysis

2. Inadequate peripheral vision

A corollary to Point 1 above is why and how operation-focused managers often miss what may be emerging at the fringe of the company’s business as they focus only on the core of the business. In this context, “core” implies the core business or business model of the company, while “fringe” means new situations emerging either at the edge or right outside the core of the company’s business (see Exhibit 6a).

Exhibit 6a

From Fringe to Core, from Core to Fringe

Source: Gao Feng Advisory Company analysis

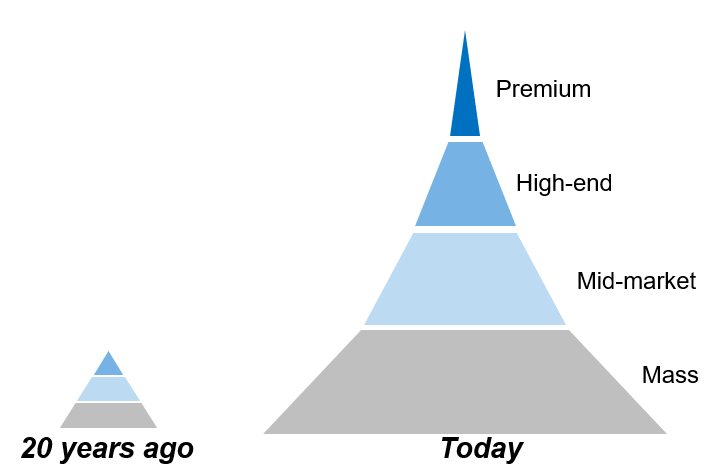

Taking product market segmentation as an example, many MNCs tend to focus on the premium segment in China because of the belief that products that are sold as premium elsewhere in the world should serve premium segments in China as well. While they are focusing on doing this, often a “mid-market” segment emerges quickly. As the MNC managers focus on the top end of the market, they are often slow to notice the emergence of the mid-market which is often serviced by the quickly emerging local competitors (see Exhibit 6b). The inadequate peripheral vision often limits what MNC managers can see in China.

Exhibit 6b

Proliferation of Demand Segments

Source: Gao Feng Advisory Company analysis

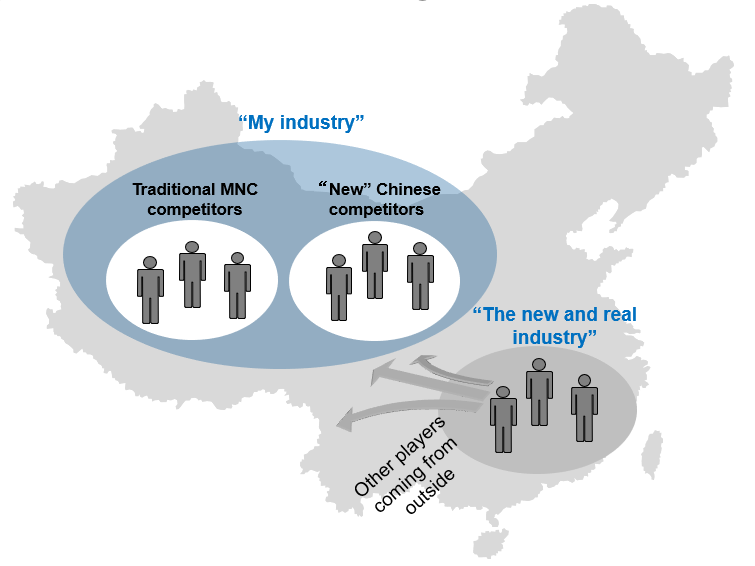

3. Missing out on new competitors

MNC managers focused upon operations typically define competitors the same as competitors they run into in other parts of the world. After they come to China, for a while, they normally run into some local competitors. But these local companies typically come from the same industries and were known to the concerned MNCs, to begin with. However, as the China context evolves, new local competitors often emerge “from nowhere in particular.” These may be smaller local companies who were able to see the emerging market opportunities and want to take some share from the market. Or, they could be local players who are already successful in other adjacent sectors. When they see the opportunities in your sector, they may decide to enter your market. Often these competitors bring with them ecosystems and capabilities that the incumbent players may not have and as such can rewrite the rules of the game (see Exhibit 7).

Exhibit 7

Where are the Competitors in China?

Source: Gao Feng Advisory Company analysis

4. Needing a better understanding of how to build capabilities

MNCs tend to regard capabilities as what they internally develop and possess. Sometimes they opt for mergers and acquisitions or form joint ventures of some kind to acquire new capabilities. Nonetheless, MNCs generally believe capabilities should be their own, owned by them. This is a heritage derived from the “core competence or capabilities-driven strategy” concept. As mentioned above, a multiple jumping strategic approach in a dynamic market like China often requires companies to form collaborative partnerships to fill the capability gaps as they jump from one opportunity to another. Commonly called “ecosystems”, formation and maintenance of these collaborative partnerships is increasingly becoming a key part of corporate strategies in China and for that matter, in China for the world context also. Operations-focused MNC managers often lack a prospective and proactive view and fail to build the right ecosystems for their companies.

Thought Leadership and Communications are Key

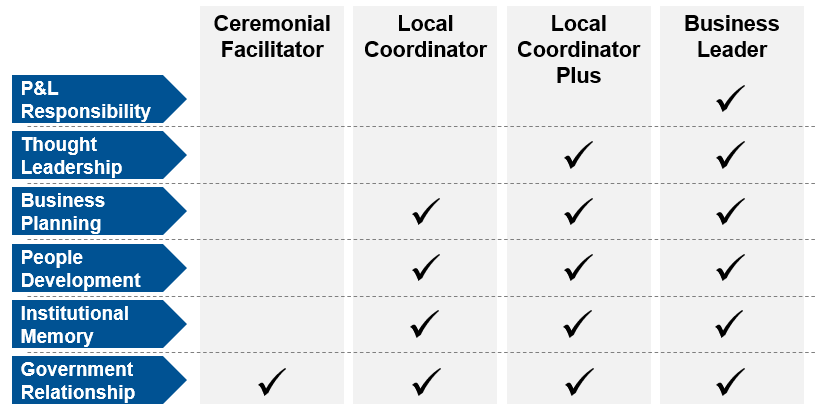

The role of a leader of China operations of an MNC varies depending on how it is defined by the MNC itself (see Exhibit 8.). The most primitive role of China head of a (typically multi-business unit) MNC is a ceremonial facilitator. The role of the China head evolves as the MNC itself internalizes the strategic importance of that position. As a full-fledged business leader of the company, the China head has to fulfill a range of responsibilities, not only for the P&L but also for thought leadership.

Exhibit 8

Different Styles and Roles of China Leadership

Source: Gao Feng Advisory Company analysis

Given the quickly evolving China context and how the context itself governs what and how MNCs should do in China, it’s critical that MNC leaders and managers in China possess a certain level of strategic thinking. The distillation of the essence of strategic thinking becomes “thought leadership.”

Shane Tedjarati, the recently retired President of Global High Growth Regions for Honeywell, a large US industrial conglomerate, and the architect of its China strategy, calls out the importance of viewing and treating the China team as a “thinking team.” By that, he means his China managers cannot simply assume “business as usual” and just execute orders. The local team has to be able to fully understand and appreciate the strategic dynamics of the China market and be able to propose viable solutions to the global headquarters and business units on what’s the right strategic approach to take in China.

Strategic thinking ability enables local managers to better communicate the conditions in China to the relevant people at global headquarters. More often than not, seniors at global headquarters are not able to intimately follow the intricacies of the developments in China and don’t have the background and knowledge to fully understand the situation on the ground. Inputs from local managers therefore are critical. Doing this right requires, first and foremost, the local managers to fully grasp what is going on in China from a strategic perspective so they can effectively convey to global headquarters what is going on in China. More often than not, there is a breakdown and a certain degree of inadequacy in such communications, leading to many of the common pitfalls mentioned above.

Needless to say, operational responsibilities are also very important for the China heads of MNCs. However, simply being operations-focused and not having adequate strategic thinking will not be sufficient for any MNC to become sustainably competitive in China. Both are required. More MNCs have now come to realize this need and are willing to make the right investment to build this capability. Given the importance of China and availability of innate talents on the ground, in due course we expect a shift in the landscape.

About the Author

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong, Professor of Managerial Practice at Cheung Kong Graduate School of Business, Adjunct Professor at the SPACE program of University of Hong Kong and Member of the Advisory Board of HKU SPACE Senior Executive Academy. He started his strategy consulting career at McKinsey’s San Francisco office in 1988 before returning to Greater China in the early 1990’s. He became one of the pioneers in China’s management consulting industry, by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He also consulted to a number of Chinese local governments on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020). He holds a SM and a SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司