GF Viewpoint | How China is Shaping Global Companies

How China is Shaping Global Companies' Organizations and Leadership

By Edward Tse

February 2022

A recent Gao Feng Advisory Viewpoint authored by CEO Dr. Tse.

We know we are living in an era of mega disruptions. Issues such as the COVID-19 pandemic, climate change, geopolitics, digital economy and digital divide, as well as the tug-of-war between globalization and de-globalization are all examples of unprecedented disruptions affecting the entire world.

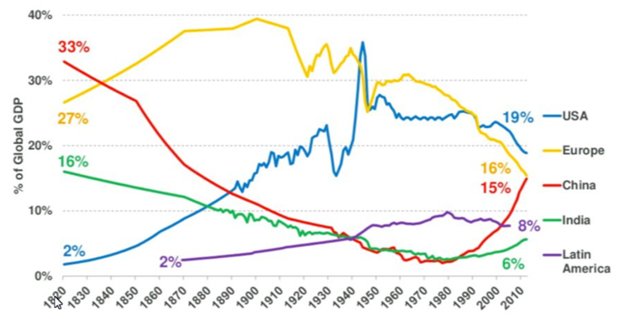

World economy in particular has undergone profound changes. Some four decades ago, China’s GDP was a tiny fraction of that of the US, then undeniably the leading economy in the world. Today, China’s GDP contributes to around 15% of the world’s total (purchasing power parity) and it is within striking distance from that of the US. This dramatic shift in the economic power structure is giving rise to great promise as well as hitherto unthinkable and unknown challenges (see Exhibit 1).

Exhibit 1

Percent of Global GDP of Select Countries (1820 - 2012, adjusted for purchasing power parity)

Source: Angus Maddison, University of Groningen, OECD, data post 1980 based on IMF data

The automotive industry is an excellent example of things to come. Cars are rapidly becoming intelligent, connected, electric, and also autonomous. This means software and electronics are becoming increasingly important components of cars and product life cycles are shortening. In parallel, the capital required for new products and technologies is increasing exponentially.

China is the world’s largest automotive market and also has a substantial digital economy overall. The government is encouraging commercialization of new energy vehicles (NEVs), making China the epicenter of this mega shift in the global automotive industry. Overall sales in China rose 3.8% year-on-year in 2021, to 26.28 million units. NEV sales were more than 4.5 million units, nearly a sixth of the total vehicle sales and more than 50% of global sales of NEVs.

China is also known for innovations in the auto industry. As China’s digital economy continues to grow, intelligent and connected vehicles are becoming increasingly prevalent. Autonomous driving is also making major progress, with best-in-class players in both hardware and software playing important roles. This development is aided by the digital infrastructure that Chinese cities are building as part of its plans for rolling out smart cities at a fast pace.

A new range of NEV players have emerged. They include a range of state-owned enterprises (SOEs) as well as privately-owned enterprises (POEs). Central government-owned SOEs such as FAW, BAIC and Chang’an and local government-owned SOEs such as SAIC and GAC are very much in the game. GAC has announced that it will be spinning off its electric vehicles (EV) subsidiary, Aion. POEs that are active include the likes of Geely, Great Wall, BYD and Chery, among others. The EV “New Forces”, i.e., those who were EV start-ups less than a decade ago have carved out their own identities and places in the market, including XPeng, NIO, Li Auto and others. Furthermore, other digital players such as Huawei, Baidu, and Xiaomi are also getting into this game.

Innovator, No Longer Copycat

In a broader context, China has evolved from being a “copycat nation” to one that is now being recognized as an innovative economy. This shift has happened roughly within the last decade.

Building on the wireless internet, many Chinese tech companies created new digital business models that addressed society’s pain points. Companies like Alibaba, Tencent, Xiaomi, ByteDance, JD.com, Pinduoduo and so on have grown exponentially during this period and many have built mega platform companies. At the same time, companies in “hard tech” sectors such as Huawei, SMIC, DJI, SenseTime and iFLYTEK have also contributed to China’s innovation and entrepreneurship in their own significant ways.

Growth of these companies has often followed a certain set of patterns. When the founders or key executives of these companies saw other successful examples, they often asked “Why not me?”, “If someone else can be successful, why can’t I?” Under the leadership of these entrepreneurs, these companies, especially during their start-up periods, are typically fast, adaptive and agile. Often, they don’t mind using the market as a test bed for their experiments, especially those whose businesses are in the consumer internet sector. They are fearless experimenters.

In fact, if we examine the leadership attributes of the disruptive Chinese private-sector auto companies, several patterns emerge. These entrepreneurs are usually serial entrepreneurs. They are not afraid of taking risks, and they have the agility to operate in and cope with fast-changing environments. They usually compete and collaborate with others at the same time, wherever necessary.

Multiple Jumps

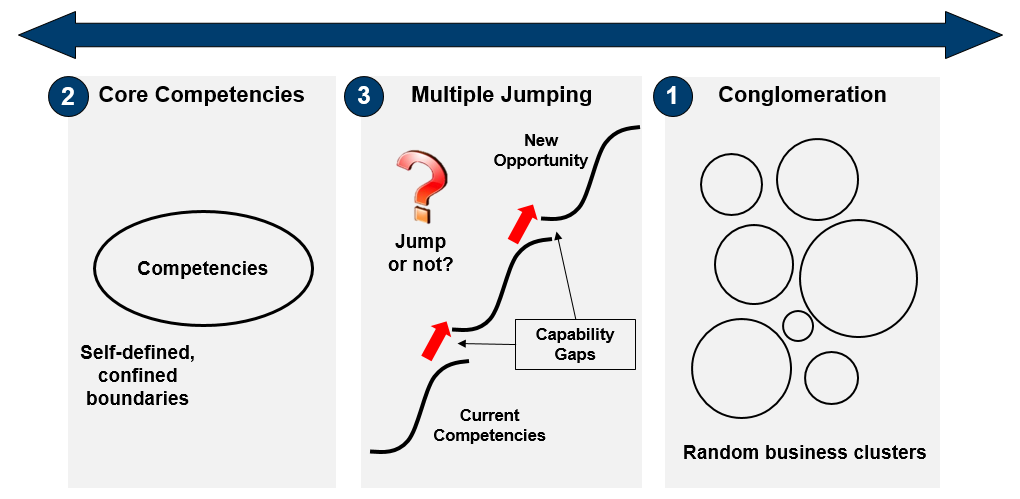

The concepts behind business strategies of companies have evolved over time. Three decades or more ago, corporate strategists liked to discuss the trade-offs between “diversification” (building conglomerates with portfolios of vast and often unrelated businesses, aiming at capturing abundant opportunities in the external environment) versus “focus” (doing business only in one’s area of strength, building on the company’s own “core competences”). Since then, the “core competence” or “capabilities-based strategy” has become the mainstream strategic framework in the business world, shaping how company executives make strategic decisions and how the capital market evaluates companies.

However, neither of these two concepts can fully explain the corporate growth phenomenon in China (and for some tech companies on the West Coast of the US), especially since some had stepped on their growth gas pedals since the commercial manifestation of the wireless internet around the late 2000’s.

In 2014, I proposed an alternative way of strategy formulation in which companies can go through rounds of “multiple jumps” to leap from an existing situation to a new opportunity even when they don’t have all the necessary experience and capabilities. Corporate leaders taking this approach constantly evaluate the attractiveness of the new opportunity versus to what extent they can build the capabilities needed to compete in the new area through either building the capabilities themselves or through collaborative partnerships (or “ecosystems”). This is what I call the “Third Way of Strategy” which bridges the theoretical gap between the first two concepts (see Exhibit 2).

Exhibit 2

The “Third Way” of Business Strategy

Source: Gao Feng Advisory Company analysis

Through a “multiple jumping” approach, many local companies, especially those in the consumer internet sector, have crisscrossed from one sector to another by leveraging underlying technologies such as wireless internet, and now increasingly, artificial intelligence, the internet-of-things, 5G, blockchain and cloud computing, to facilitate jumps when they see new opportunities. They may not have all the capabilities needed to navigate in the new space but they try to fill the gaps along the way. They would fill part of the capability gaps through building the capabilities themselves, while filling the remaining gaps through collaborative partnerships with others. Some of these multiple-jumping companies have since become large platform companies.

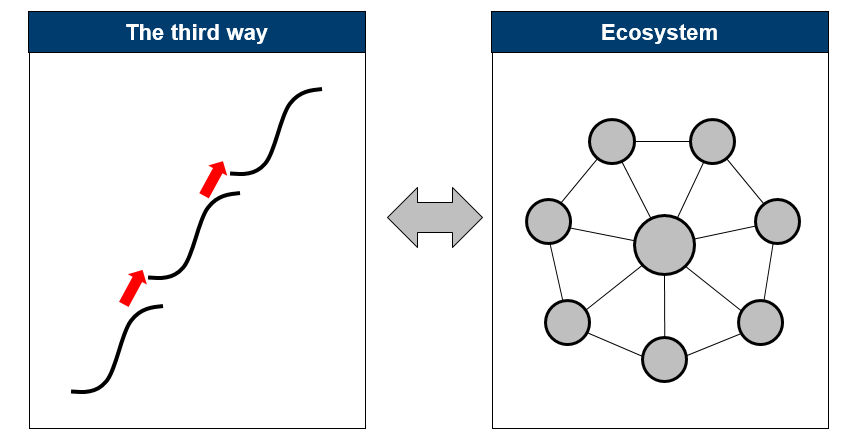

The organizational manifestation of the “Third Way” of business strategy is, therefore, business ecosystems (see Exhibit 3). In other words, business ecosystems are created out of a fundamental need of the companies to close these capability gaps as they jump.

Exhibit 3

Ecosystem is the Organizational Manifestation of the Third Way

Source: Gao Feng Advisory Company analysis

De-regulation and Proliferation of New Corporate Relationships

As the Chinese government has put technological innovation at the core of its 14th Five Year plan, it is conceivable that more disruptive changes will be forthcoming in China’s automotive sector.

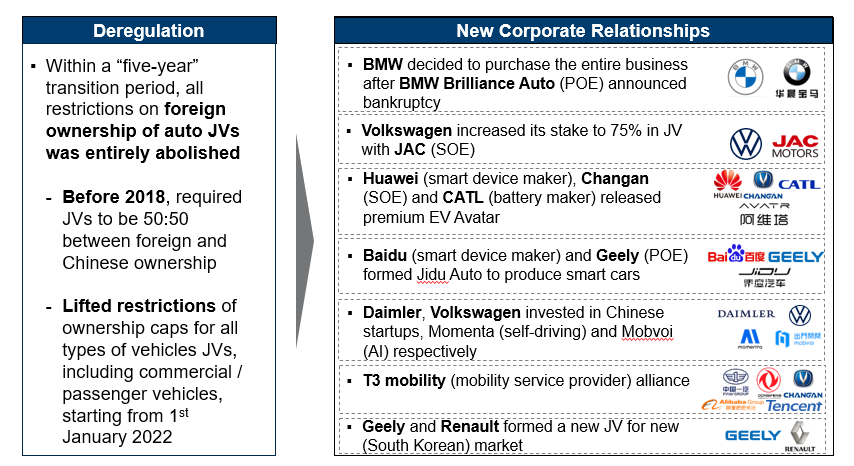

In January 2022, the Chinese government lifted all restrictions on foreign ownership of vehicle entities in China. For several decades, China required foreign auto OEMs to form joint ventures with local partners in which foreign shareholding could not exceed 50% of the total equity. That requirement is now lifted. However, instead of foreign OEMs flocking to set up their wholly-owned operations in China, a multitude of new corporate relationships have emerged invoking various permutations and combinations of Chinese SOEs and POEs as well as foreign companies. Besides OEMs, other players such as parts suppliers and software designers are also affected (see Exhibit 4). These corporate relationships seek to create new capabilities and innovations that will be needed to compete in the new era and will further disrupt the automotive industry landscape.

Exhibit 4

Deregulation of China’s Auto Industry is Leading to a Multitude of New Corporate Relationships

Source: Gao Feng Advisory Company analysis

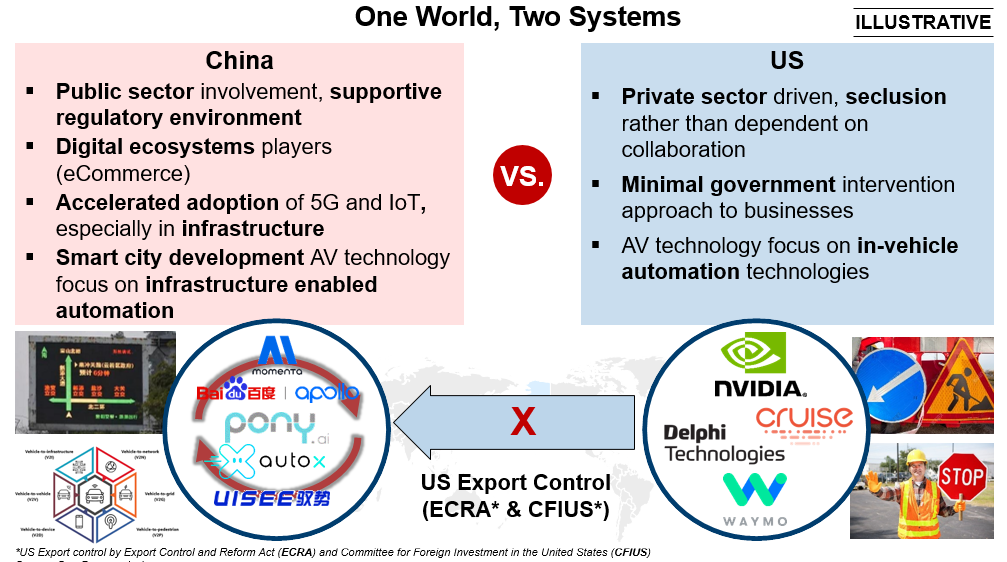

At a more macro level, the global automotive industry is now gravitating toward “One World, Two Systems”, where one system is China-centric and the other is US (or the West) centric (see Exhibit 5).

Exhibit 5

The Automotive Industry is Gravitating Towards a “One World, Two Systems” Scenario

Source: Gao Feng Advisory Company analysis

China has already built extensive digital and smart infrastructure as part of its smart cities’ development plans and this is still going on at a fast clip. This smart infrastructure enables different and often more advanced designs of new generations of vehicles as well as key components such as batteries.

China Shaping Re-think on Organizations and Leadership

Global companies with headquarters in the West have gone through periods of reflections due to changes in China. Initially they tended to copy and paste their products from the rest of the world to China and expected that to work. In many cases, it did. However, in the last decade or so, China’s policy and social environment has gone through rounds of evolution and China and Chinese companies became innovative, while global MNCs have generally been slow to react to the changing technological and business environment. That is mostly due to their own inadequate cognitive ability to observe, understand and internalize.

Today, most if not all MNCs have understood and internalized the need to change. But often they are not quite fully ready to do so because of the organizational inertia that they have accumulated over the years.

Given the macro environmental changes, they have no choice now but to change and transform themselves. To that end, leadership that leads this change will be critical. It is critical for MNCs to figure out what needs to change and how the leadership needs to manage that change. The old ways have to make way for the new ones – of thinking, of strategizing, of pushing innovation and of anticipating consumer preferences.

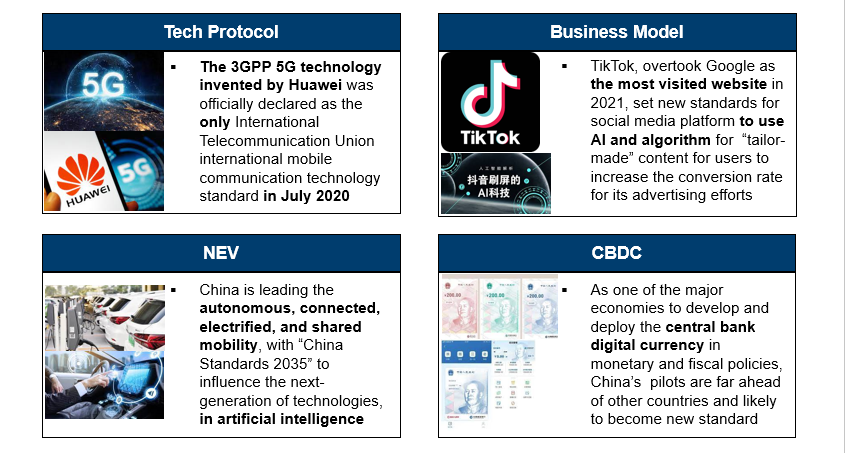

This need has become even more acute as China is evolving from building on standards set by others to becoming a setter of standards, not only for itself but increasingly for others too. There are four ways in which the Chinese are beginning to set new standards. The first is in technology protocol setting, manifesting currently in 5G rollout. The second is creating new innovative business models previously unseen.

A good example is how Chinese app TikTok has revolutionized the short-video app. In 2021, TikTok surpassed Google as the world’s most visited website. The third is disruption of industries by creating completely new industries such as the EV sector. And finally, the pioneering applications of the central bank digital currency (CBDC) which will have major ramifications for global finance (see Exhibit 6).

Exhibit 6

Year-on-Year Growth in April Has Halted a Two-year Decline in China’s Auto Market Sales

Source: Gao Feng Advisory Company analysis

The organizations of most MNCs were built up in the “old days”. That includes structure, people, capabilities, systems and processes, as well as culture and style. Every MNC needs to examine to what extent these organizational elements are still appropriate for the new era. After all, the renaissance of China is not merely technical or incremental. It’s wrapped in its long and rich history and it is transformational also.

Going forward, China will not only shape global companies’ business strategies but also its organizations and leadership.

About the Author

Dr. Edward Tse is founder and CEO, Gao Feng Advisory Company, a founding Governor of Hong Kong Institution for International Finance, Adjunct Professor of School of Business Administration at Chinese University of Hong Kong, Professor of Managerial Practice at Cheung Kong Graduate School of Business, Adjunct Professor at the SPACE program of University of Hong Kong and Member of the Advisory Board of HKU SPACE Senior Executive Academy. He started his strategy consulting career at McKinsey’s San Francisco office in 1988 before returning to Greater China in the early 1990’s. He became one of the pioneers in China’s management consulting industry, by building and running the Greater China operations of two leading international management consulting firms (BCG and Booz) for a period of 20 years. He has consulted to hundreds of companies, investors, start-ups, and public-sector organizations (both headquartered in and outside of China) on all critical aspects of business in China and China for the world. He also consulted to a number of Chinese local governments on strategies, state-owned enterprise reform and Chinese companies going overseas, as well as to the World Bank and the Asian Development Bank. He is the author of several hundred articles and five books including both award-winning The China Strategy (2010) and China’s Disruptors (2015), as well as 《竞争新边界》 (The New Frontier of Competition), which was co-authored with Yu Huang (2020). He holds a SM and a SB in Civil Engineering from the Massachusetts Institute of Technology, as well as a PhD and an MBA from University of California, Berkeley.

Gao Feng Advisory

Gao Feng Advisory Company is a professional strategy and management consulting firm with roots in China coupled with global vision, capabilities, and a broad resources network

Wechat Official Account:Gaofengadv

Shanghai Office

Tel: +86 021-63339611

Fax: +86 021-63267808

Hong Kong Office

Tel: +852 39598856

Fax: +852 25883499

Beijing Office

Tel: +86 010-84418422

Fax: +86 010-84418423

E-Mail: info@gaofengadv.com

Website: www.gaofengadv.com

Weibo: 高风咨询公司